Table of Content

They're all located in Tornado Alley — a region of the country that sees frequent tornadoes and hailstorms throughout much of the year. Below is the monthly and annual average home insurance cost by state and how it compares to the national average. The average annual rate for a home with $400,000 in dwelling coverage and $300,000 in liability and $1,000 deductible is about $3,231, according to a rate analysis by Insure.com. But rates vary significantly from state to state and from city to city. Alani Asis is a Personal Finance Reviews Fellow who covers life, automotive, and homeowners insurance.

Get a renters insurance quote today and we'll show you how easy and affordable it is to protect what you care about. Could help with medical expenses or property damage to others caused by you or members of your household, including pets. Personal liability could also help with legal expenses in the case of a lawsuit. Our experienced agents can help you with any paperwork and to manage your policy. For nearly two decades, she has been helping consumers learn how insurance laws, data, trends and coverages affect them. She enjoys translating the complexities of insurance into easy-to-understand advice and tips to help consumers make the best choices for their needs.

Compare Your Homeowners Insurance Options

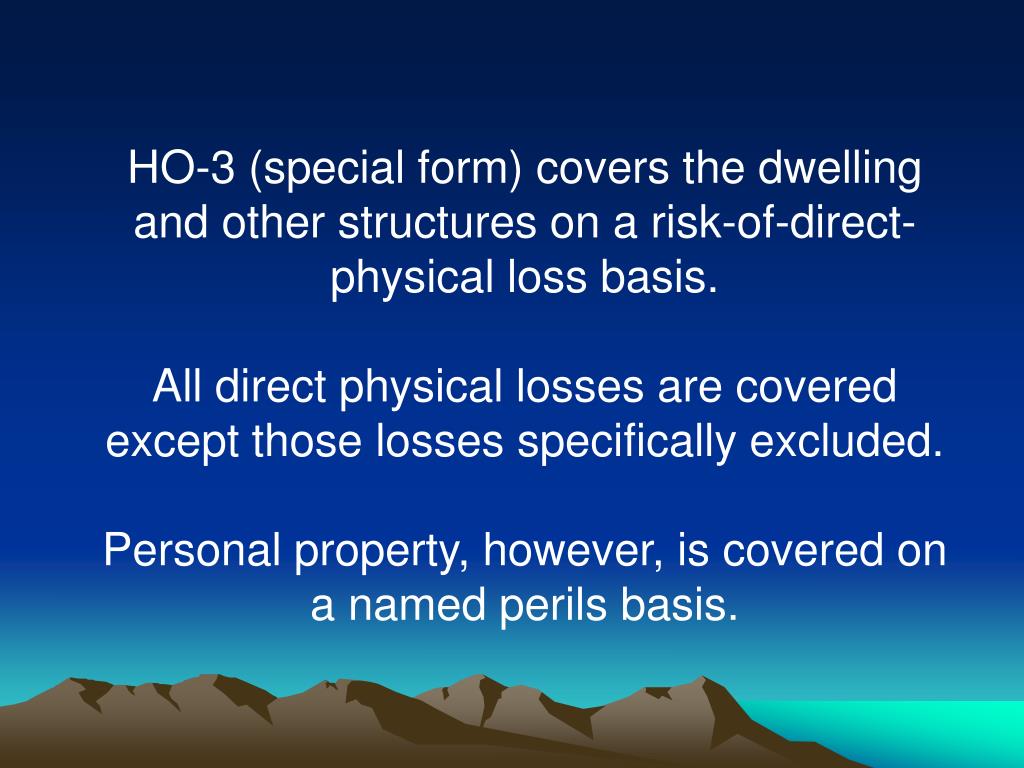

Few standard homeowners insurance policies cover dwelling or personal property damages caused by earthquakes. However, following a quake, earthquake insurance can help offset the cost of repairing or rebuilding your home, replacing damaged personal property, and temporary housing. Homeowners living in areas prone to earthquakes need earthquake insurance. Homeowners insurance policies don’t come in one-size-fits-all packages.

We do not include the universe of companies or financial offers that may be available to you. Similarly, if you live in an area with a high crime rate or an elevated risk of burglary or vandalism, you’ll likely end up paying more for home insurance. On the flip side, if you live in a safe area with few risk factors, your premiums will typically be lower. For many people, purchasing a home is the most significant financial decision of their lives. Because your home is such an important and valuable possession, you should make sure that your investment is protected.

Other structures

It’s no surprise that many of the most expensive ZIP codes for homeowners insurance are in states that experience lots of severe weather. Texas, Kansas, Oklahoma, Florida, Alabama and Mississippi have a lot of tornadoes as well. Home insurance costs per month range from thehighest in Oklahoma at $443 to thelowest in Hawaii at $49.

Home insurance costs don’t just depend on what state or city you live in — rates are calculated all the way down to your house’s ZIP code. If you live in a neighborhood that experiences frequent home break-ins or wildfires, you’ll likely see higher home insurance premiums. The least expensive ZIP code for homeowners insurance is in Honolulu, Hawaii, at $579 a year on average.

Recommended Personal Property Coverage Amounts

Scheduled personal property—also called an endorsement, floater or rider—is an optional coverage that provides more coverage for expensive items you own. Among large home insurance companies, we found Progressive was the cheapest at an average of $1,236. Travelers was the most expensive at $2,871, which is $1,635 more than Progressive. If you’re reading this article, then the chances are that your house is worth more than $150,000, which means standard insurance policies won’t cover any damage done to it.

Your financial situation is unique and the products and services we review may not be right for your circumstances. We do not offer financial advice, advisory or brokerage services, nor do we recommend or advise individuals or to buy or sell particular stocks or securities. Performance information may have changed since the time of publication. Well, since these numbers are based on average premiums for different houses and locations across the USA, it’s hard to tell. Contact your insurance agent right away if you need help in calculating your home insurance needs or are having trouble with this process.

How can you reduce the cost of your homeowners insurance?

These rates were publicly sourced from insurer filings and should be used for comparative purposes only — your own quotes may be different. On the other hand, increasing the square footage of your home could get you higher premiums. When you click "Continue" you will be taken to their website, which is not owned or operated by GEICO. GEICO has no control over their privacy practices and assumes no responsibility in connection with your use of their website. Any information that you directly provide is subject to the privacy posted on their website. If you rent an apartment, condo, house, etc., you need renters insurance.

Typically, you should carry liability coverage equal to or exceeding your assets, including investments and properties. You may see premium increases at your policy renewal even when you haven’t changed your coverage. Insurance companies often adjust your coverage limits to keep pace with inflation, which helps to ensure your home is still properly covered when things get more expensive. Your company may also have filed a rate change with your state’s Department of Insurance, which could then affect the price you pay for coverage. If you change your coverage, like adding an endorsement or increasing a coverage limit, your premium will likely change.

Umbrella insurance gives you extra protection from accidents and lawsuits. If you injure someone or damage their property, you might not have enough coverage. An umbrella policy could save you from paying out of your own pocket.

For example, adding smart home technologies or a home security system can earn a discount. Buying your home and auto insurance from the same company, called bundling, can snag a discount, too. You can choose a liability limit for home insurance, which commonly starts at $100,000, although it’s wise to have enough to cover what could be taken from you in a lawsuit. Your house doesn’t come with infinite resources at its disposal when faced with uninsured disasters like natural ones, so everything else inside it ( TVs included!), does not stay trashed forever. At the same time, savings dwindle by day due to a lack of protection against accidents outside our control; their needs involve strategy employed before too long.

Whereas – Rosenberg, Texas – is the most expensive ZIP code for home insurance. Its average annual rate is $6,638 per year, over $6,000 more expensive than the least expensive ZIP code. Oklahoma remains the most expensive state for homeowners insurance in the United States for another year. Its average annual rate is 61% higher than the national average home insurance cost. Once you figure out how much homeowners’ insurance you need, it’s time to find the price you want. Shopping around is easier than ever with Gabi as you can compare homeowners insurance rates from a wide variety of insurers online, all in one place.

Bankrate stays current on inflation, severe weather and complex challenges, and unfortunately, in at least two states, the home insurance markets have been especially volatile. All providers discussed on our site are vetted based on the value they provide. And we constantly review our criteria to ensure we’re putting accuracy first. Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. We’ve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Insure.com’s analysis of rates from top insurers for every state and nearly every city — down to the ZIP code — found theaverage cost of homeowners insurance to be $2,779. That’s the average for a home insurance policy with $300,000 in dwelling coverage, $300,000 in liability insurance and a $1,000 deductible. So if your property’s replacement cost is $800,000, your minimum coverage would equal $640,000. If you purchase less coverage (for example $512,000), your compensation would be the proportion of the $640,000 to the amount that you actually purchased. $512,000/$640,000 would give 0,8 which means your insurer will only cover 80% of the costs. So if your house suffers from a covered peril causing $200,000 worth of damages, you’ll receive only $160,000.

Meanwhile, our sample West Virginia home was built in 1974 and has $119,500 of dwelling coverage. We used median home values to approximate the rebuild cost in each state. The states with the highest home insurance costs are generally where natural disasters occur most frequently.

No comments:

Post a Comment